Become a Member for as little as $4/mo and enjoy unlimited reading of TSLL blog.

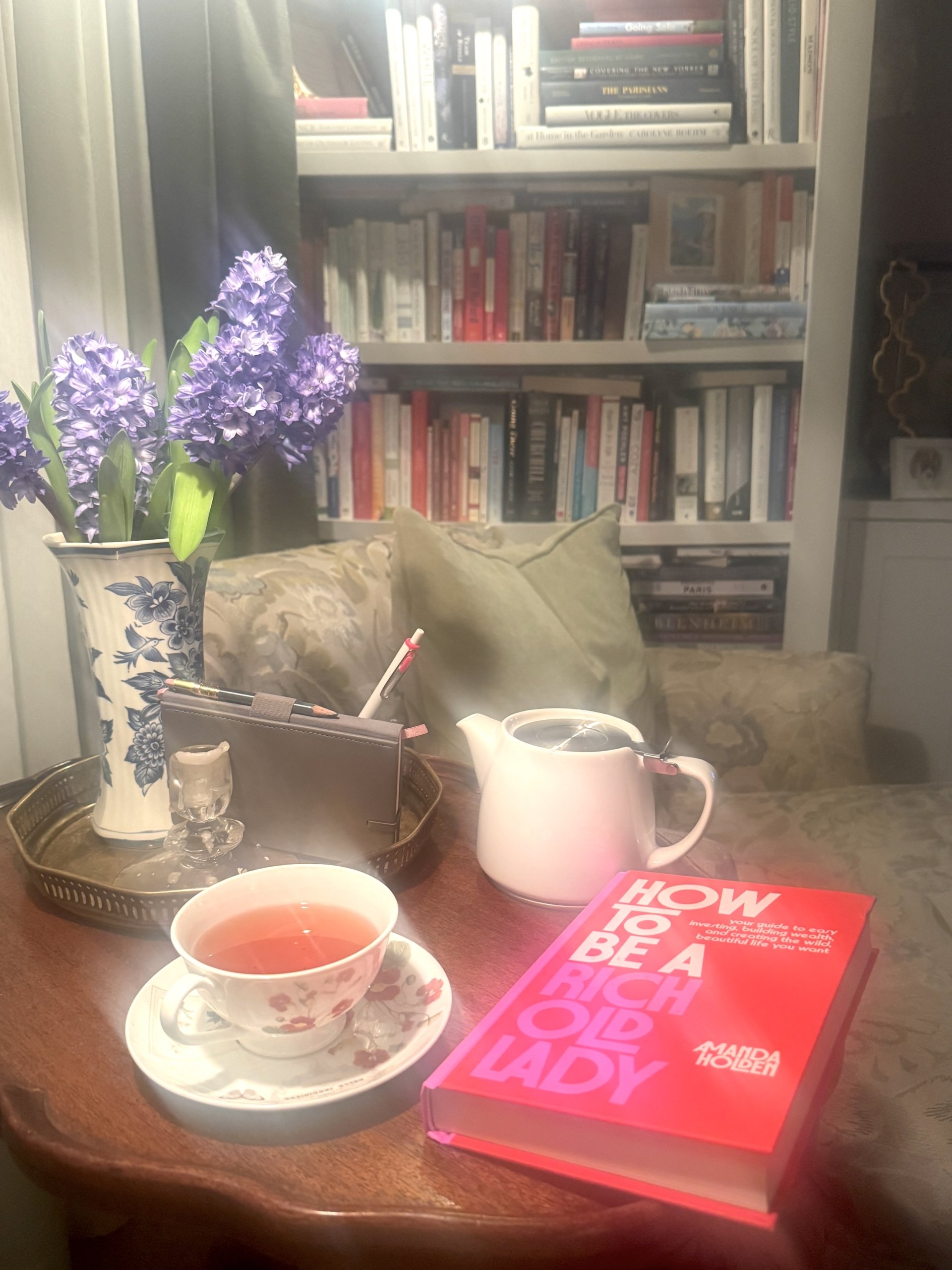

“The goal, here, is options—the power to choose the life you want. And this life is not going to happen without investing.”—Amanda Holden, author of How to Be a Rich Old Lady

The key to learning anything we don’t know is to choose to learn. Then, we need to find people who not only know what we want to acquire as knowledge, but also know how to teach it. Not only do they know how to teach it, but they sincerely want us to learn.

As this episode/post finds you, we are all at different points along our life journey regarding our age, but we also, regardless of age, are at different points regarding our knowledge of investing. Wherever you are is exactly where you need to be to begin deepening your knowledge of what will set you free once you apply the skills and language of investing that Amanda Holden teaches in her book.

Holden founded Invested Development after beginning her career in investment management. With degrees from UCLA in economics and communications, which make her a helpful guide as a teacher for the economics we want to learn, she transitioned into becoming one of the leading voices on women and money. Teaching in-person and online classes on money, her primary objective is to equip us with the tools and know-how so that finances don’t prompt fear, but instead eradicate it and give us freedom.

“To be a Rich Old Lady is to be rich in life, options, experiences, and especially love.” —Amanda Holden

In today’s episode, I’m going to share with you seven guiding truths as a way to lay the foundation of where to begin and how to maintain steady progress to becoming rich. So that you aren’t looking into your older years and fearing or wondering how you will survive, but instead are eager (but not rushing) for them to arrive because you know you will be thriving.

1. Learn the language of money

I am going to be direct and keep it simple to kick us off – pick up this book – How to Be A Rich Old Lady. Along with sharing the jargon of the financial sectors, she also gives us the history of women and money to put into context why we may have felt uncertain, insecure, or discouraged from being rich. There is no reason we cannot be rich, and it isn’t that complicated. Again, we just need someone to talk with us, not at us or avoid our questions altogether. Holden wants us to understand, and I found her clarity and oodles of examples refreshing and welcome.

So, let’s begin!

2. Start investing early

Investing early also means paying off debt and having an emergency fund, but at the same time, begin investing in an actual investment account, no matter how little. And about that emergency fund. You may have heard it as often as I heard it over the past two or three decades from folks that are deservedly well-respected in the financial industry – six months – have six months of income in your emergency. Well, get real. As a teacher, this was never going to happen. If I had waited until I had six months of savings, I would have put off beginning to invest for a decade. My investments are what enabled me to buy a home in Bend, Oregon, and to give me freedom to make decisions about my next career move – i.e., retiring early from teaching and stepping into running my own company.

Holden agrees, “You don’t have to wait until your emergency fund is fully funded before you begin your work on the other steps.” Holden goes on to implore us, “Please don’t wait until you’ve paid off all debt to start retirement investing!” She goes on to share specific math figures to demonstrate the power of compound interest, even with small regular contributions to our retirement funds.

So, do all three at once, no matter how little. Something will make a difference more than doing nothing. An important note on where to place your Emergency Fund savings: a high-yield savings account (HYSA). Holden advises looking for one n annual percentage yield (APY), and currently, you can find (online) HYSA as high as 4%.

3. Stay consistent (automate it)

No matter how little, set an amount you can afford to have deducted each month, automate it, and forget about it. As we will discuss in the next point, gradually increase the amount at regular intervals. Over time, by being consistent, you catch the market at both highs and lows, and it evens out. The more time you have in the market, the more favorable it will be. Working with a financial advisor is a helpful idea to ease your mind and to trust the decisions you make as you begin that are best for you. However, don’t feel you can’t switch financial advisors. You absolutely can and need to to suit your needs. I have switched multiple times. Remember, they are not the only financial expert, they are human, and they will have opinions about money and how it’s invested (more on that in point #7). Paired with staying informed about finances on your own – reading books, listening to podcasts hosted by other financial experts, and any other credible source – you will know when the financial advisor, should you choose one, is right for you.

Holden offers a detailed guide to the options for whom to work with, what their role entails based on their title, the expected fees (if any), and how to invest on your own (this is covered in detail).

4. Invest more as you become able

As your income increases, increase how much you invest until you’ve maxed out in whichever fund you have chosen to gain the most tax benefit. Then begin investing either in other funds or other advisable ventures. This is where a financial advisor will be helpful once you have found someone who understands your vision for your life today and moving forward. They will be able to suggest and manage (during periods of turbulence) where to place your money. However, you are still the navigator, so staying informed about what is best for you and where you are on your timeline will inform the final decision.

For example, the younger you are, the more worthwhile it is to heed the wisdom to be more ‘risky’ in your mutual fund distribution. Holden breaks all of this down in the book, as there are a few different options for being ‘risky’. Ultimately, you’re looking to gain more market share, and you may experience ups and downs in certain markets (emerging or developed; domestic or international), but this is to your benefit because you have more time in the market. As you near your retirement age, the time at which you will begin withdrawing, you become less risk-averse.

But if you don’t know where to invest, do your homework first, and Holden’s book is a great resource to give you oodles of options of where to begin based on your financial journey.

5. Understand the Tax Benefits of Investing

There are a variety of funds to invest in for retirement savings. What you choose will depend on the work you are in (as some funds are only available if you are employed by an employer or if you are the employer of a company), what type of tax benefits you are looking for, and what you need financially. Holden details all of them in clear terminology and shares examples of earnings over time.

Having moved from being a public school teacher employed by the state to being my own boss (essentially, I am both employer and employee), I have learned quite a lot about certain funds – some that are now no longer available to me and others that are newly available to me. What is crucial is that you learn the rules, i.e., how to avoid penalties (for early withdrawal, for example) and what the tax saving benefits will be. Some state pension funds will even void some or all of your pension benefits if you withdraw or rollover certain accounts, so check directly with the entities that manage your funds.

With all of that said, start investing as early as you can, and if you have children, begin investing for them – in their name/or with them if they need a guardian’s consent – as early as possible. Something that has been available for some time in the U.S. (but came after I was a child) is the 529 fund for parents. Holden gives an entire chapter to Children and investing, so definitely take a look at that. Whether you have children or not, a Roth IRA is a fund I highly recommend investing in to give yourself an account that will be free of tax penalties whenever you choose to withdraw (no age limit).

One of the best funds I invested in early in my 20s, after doing my own research and asking the financial advisor I was working with, was to invest simultaneously in a Roth IRA (while also investing in my 403 (b) and school pension). I was only able to save about $50/mo at the beginning, and not much more as my 20s rolled on, but that money eventually became the down payment on Le Papillon when I turned 40. I was able to pull it out tax-free. I am beyond grateful I began doing this when I did. Now, the caveat with the Roth is that there is a maximum income you must be below (gross income, not net) to invest in a Roth. Luckily, as a public school teacher, I easily fell under that threshold. ☺️

6. Understand how insecurity manifests

“Insecurity is the mechanism by which we are open to receiving feedback from those around us, allowing us to adjust our behavior to be a better, more harmonious member of the tribe, which was (and is) necessary for survival. But insecurity in a modern world isn’t spontaneous, or an internal sign that arises out of nowhere—it is almost always shaped by the world we live in.”

Now, at this point, following reading Holden’s quote, you may be wondering, what is she alluding to? However, once you read the book, you will have a pretty clear idea. Her frank tone is refreshing and appreciated, and especially needed reminder and counsel for women to hear. When we spend money to buy something to be a part of any ‘tribe’, we are seeking approval. So long as we never feel ‘enough’, we will keep spending and spending without first investing, which is a recipe for financial ruin for our today and, most definitely, for our tomorrows.

Specifically, we’re talking about the beauty industry. An insightful observation by writer and award-winning professor Tressie McMillan Cottom in her essay “In the Name of Beauty” (found in her book of essays, Thick, here), she points out that “beauty is the only form of capital that women are allowed without challenge, and that they are encouraged to obtain. But . . . beauty is not good capital. It compounds the oppression of gender.” And because the beauty hierarchy that has been created can never be entirely attained without constant ‘investment’ and upkeep, it can never be fully satisfied, which keeps the consumers on a perpetual wheel of spending.

Holden’s entire chapter, “Spending”, is a worthwhile read that broadens our awareness of myths we may have accepted blindly and encourages each of us to dive deeper to understand what we really need to live well and whose stories we have accepted as true when it comes to how to live well. Most importantly, know this: “So much of our consumption was never really our idea in the first place.” There are expectations within a culture that lead us to accept what we must do, be, or look like to be loved, and this is false. Each of us is enough. Because we live in a world that runs on money, what we need to understand is the language of money, as mentioned above in #1, so that we are making decisions that truly strengthen the wealth we need to live the life we truly want.

If you read only one chapter in this book, read chapter 6 – Spending, and maybe read it again. 😌

7. Surround yourself with women who are financially free

I will forever be grateful to my teaching mentor, Marthe (a thirty+ year veteran in the profession who was one year from retiring, owned her own home free and clear, and shared ownership of a second home with her husband), who gave me the best financial advice I received. As soon as I began earning a paycheck from teaching, invest tax-deferred into my own investment account, separate from the school or state I was working in. At the time, that option was a 403b account (Holden, with good reason, doesn’t like these types of funds that are solely available to non-profit employees or teachers because of their high management fees; however, often they are the only option, and it did still reduce my taxable income). Either way, with increased knowledge of the language of investing, begin investing with your first paycheck, set it up to be automated, and forget about it. I have since rolled over that account into a traditional IRA.

If you didn’t receive financial investing advice as a young adult (I sincerely hope that is not the case, but I want to acknowledge the existence of biases in our culture as it pertains to women and money – this has no reflection on you; now, you can become the financial guru you are capable of becoming), fear not. In my own journey of financial investing, my own family, unbeknownst to me, encouraged my brother to buy a house (he being younger) without ever mentioning the idea to me. Seeing my brother buy his first house, I became immediately inspired, and took it upon myself to seek out a loan for teachers (offering a reduced APR rate), and once I expressed my sincerity about buying a house, my mother’s friend’s son-in-law, who was a realtor, living in Portland, Oregon, where I was living, helped me find and buy my first home. Be assured that even without guidance or encouragement from your family, you can figure this out.

This is not to say my parents didn’t value a sound financial future for me. I will forever be grateful to my parents for valuing education and for being adamant that they would pay for both my undergraduate and graduate school tuition, leaving me without the burden of student loan debt upon graduation. As a public school teacher, repaying my loans would have taken a tremendous amount of time and limited my ability to start investing when I began my first teaching job. This is not lost on me. To that point, my brother and I took different paths after high school, and my parents supported us emotionally and financially, as our circumstances allowed, giving us a solid foundation from which to begin our lives. Also, keep in mind that I began attending college in 1997; I recognize that the cost of college today is drastically different. All of this is to say, as adults, no matter what our foundation financially may have been, we now can direct our own future, and it begins by educating ourselves about investing.

There is often an unconscious (hopefully not conscious, but it is possible) about women handling money, but it is a false truth. We only perpetuate the belief by accepting it. Holden reminds readers about a truth not often shared, but important to realize: “When women do invest, the data shows they are better at it than men. Not because they take bigger risks, but because they don’t take as many stupid ones.” Her words, not mine. Like I said, she is frank, and ultimately, it comes from frustration knowing the history of women, money, and the culture of the two.

All of this is to say, surround yourself with women who are financially independent, whether they are in a relationship, married, widowed, single, divorced, you get the idea. You don’t have to accept everything you hear, but listen, learn, ask questions. You will quite quickly become aware of which women are financially savvy, and most will be happy to share because if anywhere along the way they were dismissed, ignored, or seen to be treated differently simply because, upon reflection or maybe realized it in the moment, they were a woman, they won’t want you to experience the same thing. I have a few experiences of my own, walking into a brokerage firm, and being given dismissive advice because I didn’t have any children (why have money left over when you die? Spend, spend, spend!), or because I was a teacher and didn’t have enough income to be considered a client. Needless to say, the community of women or anyone who understands that all people deserve to have financial freedom, are priceless folks to surround yourself with.

With all of that said, there is so much more we could discuss. How to Be a Rich Old Lady is a resource I highly recommend picking up. She talks about investing in HSAs, and what they are and whether to consider them (and who created them and why in the first place), she talks about home ownership, social security, and offers a retirement estimation to determine how much you will need and therefore, how much you need to invest today. She even explores ethical investing and cryptocurrency. The language of investing is indeed its own language, but it isn’t difficult to understand so long as you have a teacher whose objective and motivation is for you to understand it, not be kept in the dark and further confused, so much so that you throw your hands up and say, this isn’t for me. Wrong! It is for you! It is for each of us, and we can do it. The complexity of investing is a false truth, and we put the keys in our hands when we choose to educate ourselves. This book is a helpful place to start, and, in conclusion, Holden shares additional resources worth exploring to deepen your knowledge of investing.

Holden acknowledges that she is just one teacher with one perspective, but she advises, “Don’t wait until you know everything, because that will never happen. Invest, yes—but don’t forget to live. Investing in yourself is about much more than index funds and compound returns. Be deeply invested in you and making the most of your one shot on this insane cosmic marble.”

We absolutely can arrive at the latter half of our life truly rich, both literally and figuratively. This eliminates fear and allows us the ability to thrive every year of our lives because we will be able to invest in things that make our life enriching. An enriched life will be different for each of us, but each of us will have the freedom to choose once we become financially free. We give that to ourselves by investing today.

SIMILAR POSTS/EPISODES YOU MIGHT ENJOY

episode #413: 13 Ways to Finesse the Art of Spending Money

episode #354: How to Find Your Financial Freedom: The Importance of Understanding, Writing and LIVING Your Love Story with Money

~Explore all of TSLL’s Money posts in the Archives here.

~Watch the trailer of TSLL’s upcoming new book – Savoring the Sojourn (below); and read a detailed post about the book, inspiration, content and more here.

Petit Plaisir

~Tom and Lola, MHzChoice

~Watch the trailer below:

To advertise on this podcast please email: ad-sales@libsyn.com

Or go to: https://advertising.libsyn.com/thesimplesophisticate

Thank you for this. This is such an important topic for women.

Now I am on my way to read chapter 6.

And I am really excited for your new book!

Have a great week

Tickled to hear it spoke to you. 😌 We’ve got this!